Shopify's Financial Analysis and Growth Potential

Table of Contents

- Introduction

- Shopify's Stock Performance

- Financial Analysis of Shopify

- Free Cash Flow

- Debt

- Gross Margin

- Profit Margin

- Other Incoming Expenses

- Shopify's Growth Potential

- Analysts' Opinions on Shopify

- Stock Analyzer Tool

- Conclusion

- FAQs

Shopify: A Financial Analysis of the E-commerce Giant

Shopify, the Canadian e-commerce giant, has been making waves in the stock market lately. Despite a down day in the market, Shopify's stock price rose by 5.5% on November 19, 2021, hitting an all-time high of $176. This is a significant increase from just three months ago when the stock hit a low of $23.

In this article, we will take a closer look at Shopify's financials, growth potential, and what analysts are saying about the company. We will also use a stock analyzer tool to determine whether Shopify is a good investment opportunity.

Shopify's Stock Performance

Shopify's stock has been on a rollercoaster ride over the past few years. The stock hit an all-time high of $1,499 in February 2021, but it has since fallen by more than 75%. Despite this, Shopify's stock is still considered expensive, with a five-year PE of 1,250 and a five-year price of free cash flow of 667.

On November 19, 2021, Shopify's stock price hit an all-time high of $176, which is a significant increase from just three months ago when the stock hit a low of $23. This increase is even more impressive considering that Shopify is raising its prices from $29 to $39.

Financial Analysis of Shopify

Free Cash Flow

Shopify's free cash flow was negative $200 million last year. However, the good news is that the company doesn't have much debt. The difference between its market cap and enterprise value is essentially its net debt, which is a positive sign.

Debt

Shopify's debt is relatively low, which is a good sign for investors. The company has a market cap of $51.4 billion and an enterprise value of $52.5 billion.

Gross Margin

Shopify's gross margin is 50.5%, which is a positive sign. This number should increase when the company raises its prices.

Profit Margin

Shopify's profit margin is negative 61%. However, this number is skewed because the company had a big write-off last year. The previous year, the company had a big gain of 3.37 billion, which also skews the numbers.

Other Incoming Expenses

Shopify's other incoming expenses were minus $2.92 billion. If you add that back in, it's still a loss. However, the company is still growing.

Shopify's Growth Potential

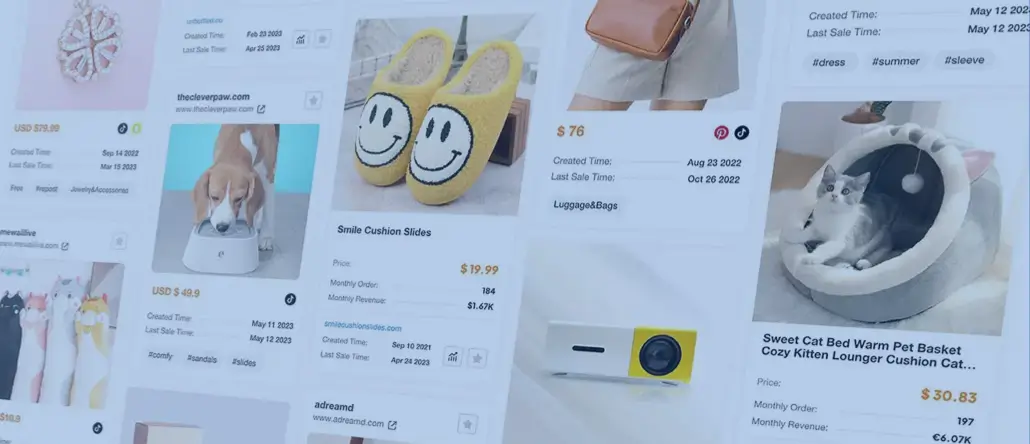

Shopify is a growing company, and it has done a great job for a lot of customers. During the COVID-19 pandemic, Shopify's revenue jumped significantly. The company has a lot of potential for growth, but investors should do their research to find out how the company is growing and what its potential market size is.

Analysts' Opinions on Shopify

According to analysts, Shopify is expected to make a profit of three cents a share this year and 57 cents a share in three years. If you want to be aggressive and pay 25 times earnings in the next three or four years, the stock is still only at $15. The revenue growth is high, but it's declining, according to analysts.

Stock Analyzer Tool

Using a stock analyzer tool, we can determine whether Shopify is a good investment opportunity. Assuming revenue growth of 7%, 11%, and 15%, profit margins of 8%, 14%, and 20%, and free cash flow margins of 6%, 12%, and 18%, we can estimate the stock's future price. Assuming a PE of 15, 18, and 21, and a desired annual return of 13%, 17%, and 21%, we can estimate the stock's future price.

Based on these assumptions, the stock's low, middle, and high prices are $10, $16, and $21, respectively.

Conclusion

Shopify is a growing company with a lot of potential for growth. However, investors should do their research and use a stock analyzer tool to determine whether the stock is a good investment opportunity. While Shopify's stock price has been on a rollercoaster ride over the past few years, it is still considered expensive, and investors should be cautious.

FAQs

Q: What is Shopify?

A: Shopify is a Canadian e-commerce company that provides a platform for businesses to create online stores.

Q: Is Shopify a good investment opportunity?

A: Shopify has a lot of potential for growth, but investors should do their research and use a stock analyzer tool to determine whether the stock is a good investment opportunity.

Q: What is Shopify's stock price?

A: As of November 19, 2021, Shopify's stock price is $176.

Q: What is Shopify's revenue growth?

A: According to analysts, Shopify's revenue growth is high, but it's declining.

Q: What is Shopify's profit margin?

A: Shopify's profit margin is negative 61%, but this number is skewed because the company had a big write-off last year.