Complete Guide to Setting up GST on Shopify Store

Table of Contents

- Introduction

- Importance of Setting up GST on Shopify Store

- Step-by-Step Guide to Setting up GST on Shopify Store

- Accessing Shopify Settings

- Finding Taxes and Duties

- Setting up Taxes for Different Use Cases

a. Use Case 1: Selling the Same Kind of Product

b. Use Case 2: Selling Products with Different GST Values

c. Use Case 3: Setting up GST for Clothing Store

- Providing GST Invoices to Customers

- Using Store Tools' JC Pro Invoices and Reports App

- Conclusion

Setting up GST on Shopify Store: A Comprehensive Guide

Shopify has become a popular platform for Indian store owners to set up their online stores. However, it is crucial for these store owners to ensure that they are compliant with Indian tax regulations, especially when it comes to Goods and Services Tax (GST). In this article, we will guide you through the step-by-step process of setting up GST correctly on your Shopify store.

Importance of Setting up GST on Shopify Store

Before we delve into the technicalities, let's take a moment to understand why setting up GST correctly is important for your online store. GST is a mandatory tax imposed by the Indian government on the supply of goods and services. Failing to comply with GST regulations can lead to hefty fines and legal complications for your business. By setting up GST on your Shopify store, you ensure that the appropriate tax is calculated and collected from your customers, making your business compliant and reducing the risk of any penalties.

Step-by-Step Guide to Setting up GST on Shopify Store

1. Accessing Shopify Settings

To begin setting up GST on your Shopify store, log into your Shopify account and navigate to the settings section. This can be found in the left sidebar of your dashboard.

2. Finding Taxes and Duties

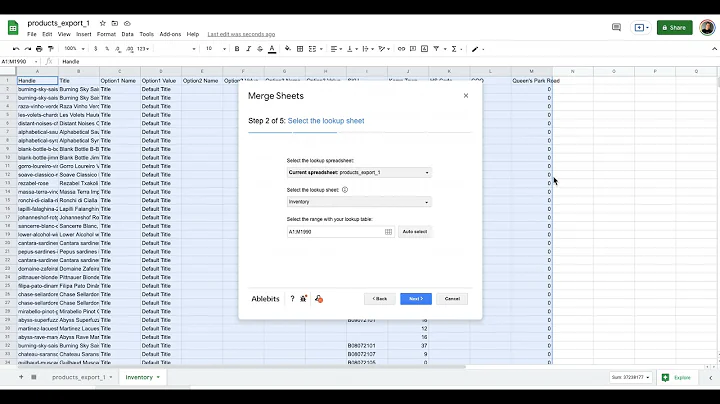

Within the settings section, locate the "Taxes and Duties" option and click on it. From the dropdown menu, select "India" as the country for which you want to set up taxes.

3. Setting up Taxes for Different Use Cases

Now that you are inside the taxes and duties settings for India, we will guide you through different use cases and how to set up GST accordingly.

Use Case 1: Selling the Same Kind of Product

If your entire store sells the same kind of product, such as a toy store with mostly identical toys, you can easily determine the HSN value for your product. Use an online GST HSN lookup website to find the appropriate HSN value for your product. For example, if you sell toy guitars and the HSN value is 95030010 with an 18% GST rate, you can copy this information.

Next, go back to Shopify and locate the tax settings for your store. Here, you will see a field where you can enter the GST rate for your products. If the rate is already set correctly, you can move on. However, if it is incorrect, you can reset the taxes to default and then enter the correct GST rate.

Use Case 2: Selling Products with Different GST Values

In some cases, you may sell products with different GST values. Let's say you have a product, like a toy balloon, with a GST rate of 5%. To set up GST for this product, you can create a collection specifically for products with a 5% GST rate. Save the collection and then go back to the tax settings in Shopify.

Select the appropriate collection and enter the half of the GST rate (e.g., 2.5% in this case) in the "Country tax" field. Then, add overrides for each state by selecting the collection and entering the 5% GST rate for each state individually. Make sure to save your changes.

Repeat this process for any other products with different GST values, creating collections and applying the corresponding GST rates in the tax settings for each collection.

Use Case 3: Setting up GST for a Clothing Store

If you have a clothing store with different GST rates for different categories of clothes (e.g., 5% for clothes below 1000 rupees and 12% for clothes above 1000 rupees), you will need to create two separate collections for these categories.

Once you have created the collections, follow the same process as in Use Case 2, applying the appropriate GST rates for each collection in the tax settings.

Providing GST Invoices to Customers

In order to comply with GST regulations, you may need to provide GST invoices to your customers, even if you are not collecting taxes. This helps in transparency and ensures that customers are aware of the GST implications. Store Tools' JC Pro Invoices and Reports app offers a solution for generating GST-compliant invoices. By using this app, you can provide your customers with detailed invoices that show the split up of taxes, even if you are not collecting them at the checkout.

Using Store Tools' JC Pro Invoices and Reports App

Store Tools' JC Pro Invoices and Reports app is designed to enhance your GST compliance on Shopify. With this app, you can generate professionally designed GST invoices and access detailed reports for your store. The app provides two templates to choose from for your invoices, allowing you to customize the appearance as per your brand requirements.

The app also offers JC reports, which provide a comprehensive view of your store's sales, credit notes, and a summary of your GST activities. These reports can be invaluable for staying organized and ensuring proper compliance with GST regulations.

To learn more about Store Tools' JC Pro Invoices and Reports app and its features, visit Shopify's App Store and search for "JC Pro Invoices and Reports."

Conclusion

Setting up GST correctly on your Shopify store is a vital step towards ensuring compliance with Indian tax regulations. By following the step-by-step guide provided in this article, you can confidently set up GST for your online store, taking into account different use cases and product categories. Additionally, utilizing Store Tools' JC Pro Invoices and Reports app can further streamline your GST compliance efforts and provide a professional solution for generating GST invoices. Stay compliant, offer transparency to your customers, and grow your online business with the right GST setup on Shopify.