Step-by-Step Guide: How to Use Wise for International Money Transfers

Table of Contents

- Introduction

- Understanding Wise (formerly TransferWise)

- How to Sign Up for Wise

- Creating a Wise Account

- Verifying Your Identity

- Choosing the Currency and Transfer Type

- Entering Recipient Details

- Checking the Summary and Confirming the Transfer

- Making the Bank Transfer

- Tracking the Transfer

- Conclusion

Article

Introduction

In this article, we will explore the step-by-step process of transferring money using Wise (formerly known as TransferWise). Wise is a platform that allows individuals and businesses to carry out international money transfers with low fees and favorable exchange rates. We will learn how to sign up for Wise, create an account, verify our identity, choose the currency and transfer type, enter recipient details, confirm the transfer, make the bank transfer, and track the progress of our transfer.

Understanding Wise (formerly TransferWise)

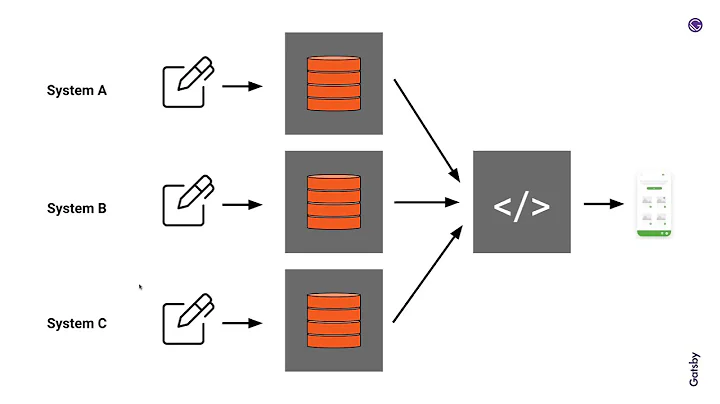

Before we dive into the transfer process, let's take a moment to understand what Wise is and how it works. Wise is a financial technology company that specializes in international money transfers. Unlike traditional banks, Wise uses a peer-to-peer system, matching transfers between individuals who want to convert their money from one currency to another. This allows Wise to provide competitive exchange rates and significantly lower fees compared to traditional banks.

How to Sign Up for Wise

To get started with Wise, you'll need to sign up for an account. Follow these steps to create your Wise account:

- Visit the Wise website or use the referral link provided in this article.

- Click on the "Sign up" or "Get started" button.

- Enter your email address and click on "Claim your fee-free transfer."

- Choose between a personal or business account based on your needs.

- Select the country where you reside.

- Verify your phone number by entering it and submitting the verification code.

- Choose a password for your Wise account.

Once these initial steps are completed, you will have successfully created your Wise account.

Creating a Wise Account

After signing up for Wise, you will be directed to your Wise account dashboard. Here, you can access various features and options provided by Wise. The dashboard serves as an overview of your accounts, allowing you to open different currency accounts for more efficient spending abroad.

Additionally, you can order a Wise credit or debit card, which can help you save on fees and simplify currency conversions. However, for the purpose of this tutorial, we will focus on how to transfer money abroad using Wise.

Verifying Your Identity

As a regulated financial company, Wise is required to verify the identity of its users. To complete the identity verification process, Wise will ask for certain personal details and documentation. Follow the instructions provided by Wise to upload the necessary documents and verify your identity. This step ensures the security and legitimacy of your Wise account.

Choosing the Currency and Transfer Type

Now that your Wise account is set up and verified, let's proceed with initiating a money transfer. Start by clicking on the "Send money" button at the top left corner of your Wise account dashboard. Here, you will enter the details for your money transfer.

The first decision you need to make is the currency you want to send and the currency in which the recipient should receive the money. Wise provides two options: "Same currency" and "International."

If you choose "Same currency," both the sending and receiving currencies will be the same. This option is suitable when you don't require currency conversion and want to keep the funds in the same currency.

On the other hand, if you choose "International," you can send money in one currency and have it converted into another currency for the recipient. This option is useful for saving on conversion fees and providing convenience to the recipient.

Entering Recipient Details

After deciding on the currency and transfer type, you will need to enter the recipient's details. Provide the recipient's email address, as Wise will send them a notification about the money transfer. If you are aware of the recipient's bank account details, you can fill them in. Otherwise, Wise can send an email to the recipient to request their bank details.

Depending on the currencies involved in the transfer, you will have different options for specifying the recipient's bank account. For example, if you are sending British pounds (GBP) and the recipient's account is in the United Kingdom, you can choose to send it directly to a local bank account. Alternatively, if you don't have a local bank account, you can use an International Bank Account Number (IBAN) for global transfers.

Checking the Summary and Confirming the Transfer

Before proceeding, carefully review the summary of your money transfer. This summary includes details such as the transfer fee, the amount to be sent after deducting the fee, the conversion rate, and the estimated time for the transfer to arrive. Ensure that all the information is correct before clicking on "Continue" to proceed.

If you have used a referral link to sign up for Wise, you may be eligible for a free transfer up to a certain amount. This benefit will be reflected in the summary, where the fee will be deducted from the transfer amount.

Making the Bank Transfer

At this stage, you will need to initiate the bank transfer from your bank account to Wise. Depending on your chosen payment method, you can opt for online banking, telephone banking, or visiting a bank branch. Select the method that is most convenient for you and click on "Continue to payment."

Wise will provide you with the necessary bank account details for the transfer. Make sure to note down the IBAN number or take a screenshot of the information. It's crucial to include the correct reference number provided by Wise to ensure that the funds are correctly allocated to your money transfer.

Tracking the Transfer

After making the bank transfer, you can track the progress of your transfer on the Wise dashboard. Navigate to the "Transactions" section, where you should be able to see the money transfer you initiated. Clicking on the transfer will provide you with detailed information, including the payment status and expected arrival times.

If you need to cancel the transfer or share the transfer details with the recipient, options are available within the Wise dashboard.

Conclusion

In conclusion, Wise offers a simple and cost-effective solution for international money transfers. By following the step-by-step process outlined in this article, you can easily sign up for Wise, create an account, verify your identity, initiate a money transfer, and track its progress. This platform provides transparency, low fees, and competitive exchange rates, making it an excellent choice for individuals and businesses in need of efficient cross-border transactions. Step into the world of Wise and experience hassle-free money transfers like never before.

Highlights

- Wise (formerly TransferWise) allows for low-cost international money transfers with competitive exchange rates.

- Signing up for Wise is easy, and it offers both personal and business accounts.

- Wise requires identity verification to ensure security and regulatory compliance.

- The currency and transfer type can be chosen based on individual preferences and requirements.

- Recipient details play a crucial role in completing a successful money transfer.

- Confirming the transfer summary is essential before proceeding with the transaction.

- Initiating a bank transfer is a necessary step to fund the money transfer.

- Tracking the progress of the transfer provides visibility and peace of mind.

- Wise simplifies and streamlines the process of transferring money abroad.

- Wise offers a reliable and cost-effective option for individuals and businesses alike.

FAQ

Q: Is Wise safe and secure?

A: Yes, Wise prioritizes the security and privacy of its users. The company is regulated and compliant with financial laws and regulations.

Q: What are the fees for using Wise?

A: Wise charges transparent and low fees, which are often significantly lower than traditional banks. The exact fees depend on the currency and transfer type chosen.

Q: Can I use Wise for business transfers?

A: Yes, Wise offers both personal and business accounts, making it suitable for individuals and businesses alike.

Q: How long does a Wise transfer take to arrive?

A: The time it takes for a Wise transfer to arrive depends on various factors, including the currencies involved and the chosen transfer type. Wise provides estimated arrival times during the transfer process.

Q: Can I cancel a Wise transfer?

A: Yes, Wise allows users to cancel a transfer if it hasn't been processed yet. However, cancellation may not be possible once the transfer is already in progress.

Q: Can I track the progress of my Wise transfer?

A: Yes, Wise provides a tracking feature on the account dashboard, allowing users to monitor the status and expected arrival times of their transfers.

Q: Does Wise offer currency conversion services?

A: Yes, Wise facilitates currency conversion as part of its money transfer service. Users can send money in one currency and have it converted into another currency as needed.