The Truth Behind Passive Income

Table of Contents:

- Introduction

- Understanding Passive Income

- Investment Income

- The Requirement of Capital

- Merits and Risks

- Misrepresentations and Gimmicks

- Entrepreneurial Income

- The Misnomer of "Passive"

- Time and Effort Involved

- Online Ventures and Their Pitfalls

- The Illusion of Low Effort and High Returns

- Drop Shipping as an Example

- Factors for Success: Timing, Luck, and Effort

- Selling Passive Income Strategies

- The Reality of Passive Income

- Front-loading Work

- Continual Effort for Sustained Revenue

- Pursuing Passive Income Strategies

- Pursuing Passion and Supplemental Income

- Evaluating Time and Capital Investment

- Conclusion

Passive Income: The Reality Behind the Hype

In the realm of personal finance, few topics captivate people's attention like the concept of passive income. The allure of earning money without lifting a finger is undeniably appealing. Countless videos and ads promote the idea that millionaires have multiple streams of passive income, suggesting that we should too. However, the truth is that passive income, as it is commonly presented, doesn't actually exist. In reality, most of the so-called passive income strategies advertised online are either misrepresented or outright fabricated to prey on the financially desperate.

Introduction

The notion of passive income revolves around an income stream that requires minimal active involvement once set up. The idea is that one can have more time to enjoy leisure activities, such as lounging by the poolside or playing video games, while the money keeps flowing in. However, true passive income, in its purest sense, is virtually non-existent, except for rare occurrences like winning the lottery or receiving an unexpected windfall.

Understanding Passive Income

When people talk about passive income, they are generally referring to one of two things: investment income or entrepreneurial income. While these approaches can change how one is compensated for their efforts, they do not eliminate the need for effort entirely. It is crucial to dispel the misconception that passive income offers high rewards without any effort.

Investment Income

Investment income involves owning assets that generate a yield, such as stocks, bonds, or rental properties. While these can be legitimate sources of income, they require a significant amount of capital to begin with. It is often overlooked that four of the seven streams of income mentioned by millionaires in a 2002 IRS report require substantial initial investment.

The Requirement of Capital

To illustrate, suppose one aims to replace an average yearly income of $42,000 by earning a reliable 7% return on their money. In that case, they would need to accumulate $600,000 in net savings. However, amassing such capital is no easy feat for the average individual.

Merits and Risks

Although investment income can be a powerful tool for financial freedom, it is not without its risks and costs. Strategies promising quick returns with low effort, such as investment bots or real estate courses, often fail to disclose the true risk-reward trade-off. Real estate, for instance, is a viable investment, but it comes with unexpected costs and risks that can undermine profitability, especially for those without sufficient cash buffers.

Misrepresentations and Gimmicks

Many investment strategies claim to offer passive income without the need for significant capital or effort, such as investment bots or get-rich-quick real estate courses. However, these products often present a distorted view of the true risks involved. Trading bots tend to rely on survivorship bias, and courses promising easy success in real estate overlook the substantial risks and costs that can sink an unprepared investor.

Entrepreneurial Income

Another avenue often associated with passive income is entrepreneurial income, which includes royalties, licensing, and business profits. However, the notion of entrepreneurial income being truly passive is somewhat laughable. According to a New York Enterprise report, small business owners on average work twice as hard as their employees, with many putting in over 60 hours a week.

The Misnomer of "Passive"

Leaving a traditional nine-to-five job to pursue a business venture with the hope of achieving passive income is often an unrealistic expectation. Entrepreneurial endeavors, even those promoted as passive, require ongoing effort, marketing, and maintenance to sustain and grow the income stream.

Online Ventures and Their Pitfalls

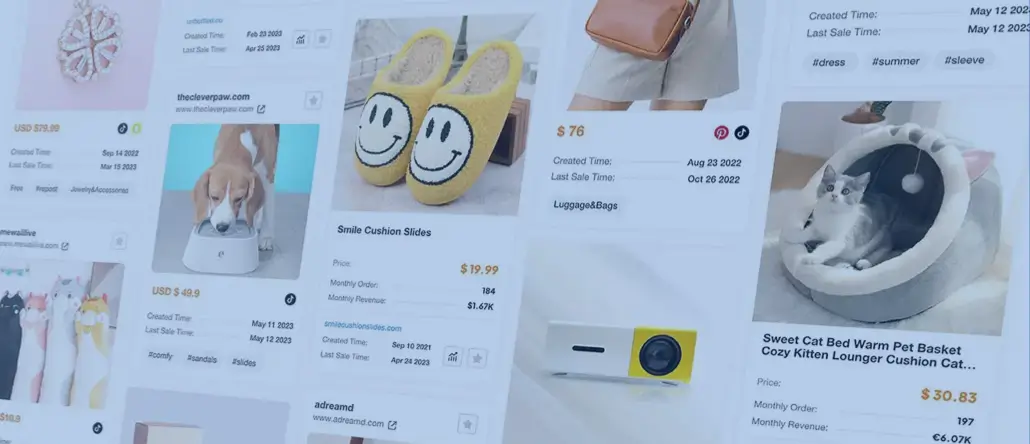

Numerous online ventures promise effortless income, such as drop shipping stores, ad placement strategies, or selling digital products. While these can generate money, they still demand time and effort. Drop shipping, for instance, involves building an online store that sells products manufactured and shipped by third parties. Though the setup is relatively easy, the market saturation and intense competition make it challenging to achieve sustained profitability.

The Illusion of Low Effort and High Returns

Many passive income strategies boast of low effort and high returns, but in reality, this illusion is shattered when scrutinized. Take drop shipping as an example. Its basic premise is an online storefront that sells products without physically handling inventory. While the initial setup may seem simple and low-cost, the market saturation often leads to an overabundance of similar products. This oversupply diminishes opportunities for profit, making sustained income difficult.

Factors for Success: Timing, Luck, and Effort

Despite the potential pitfalls, there are instances of success in passive income strategies. However, these instances often involve a combination of factors, such as timing, luck, and significant effort. First-mover advantage plays a crucial role, as those who capitalize on emerging trends may experience initial success. Additionally, luck is a prevalent factor in the competitive digital market, where countless creators vie for attention and profit. Lastly, sustained success with online ventures depends on putting in considerable time and effort to stand out among the crowd.

Selling Passive Income Strategies

One of the most profitable passive income strategies is ironically selling the idea of passive income itself. Videos and ads promoting passive income ideas gain significant traction due to the financial appeal of making money effortlessly. Many online entrepreneurs earn substantial profits by selling courses or programs that promise to reveal secret strategies. However, these products often provide biased success stories while overlooking the overall success rates.

The Reality of Passive Income

It is crucial to recognize that passive income often requires front-loading work rather than eliminating effort altogether. Most passive income strategies demand ongoing maintenance, marketing, and adaptation to sustain revenue over time. Success is contingent upon the application of effort, seizing opportunities, and managing the long-term viability of the income stream.

Pursuing Passive Income Strategies

While passive income strategies can be pursued as supplemental income or to monetize one's passion, they require careful evaluation of the time and capital investment. It is essential to consider the sustainability and profitability of the chosen strategy and to avoid falling prey to expensive courses or programs promising easy success.

Conclusion

Passive income remains an alluring concept, but its reality is far from the hype. Understanding the nuances and the effort needed to succeed is crucial before embarking on any passive income venture. While there are legitimate opportunities to earn additional income, it is essential to approach them with realistic expectations, fully aware of the time, effort, and potential risks involved.