8 Steps to Becoming a Teenage Millionaire

Table of Contents

- Introduction

- Step 1: Decide How Much to Invest

- Step 2: Find a Way to Safeguard Your Money

- Step 3: Set Up the Infrastructure for Investing

- Step 4: Expand Your Knowledge and Stay Informed

- Step 5: Start a Business or Freelance Gig

- Step 6: Live Below Your Means

- Step 7: Increase Your Investment Percentage

- Step 8: Achieve Financial Freedom

- Conclusion

Article

Introduction

Are you a teenager dreaming of becoming a millionaire or even a multi-millionaire by the age of 25? If so, you're in the right place. In this article, I will share with you the eight steps I took to reach a net worth of $10 million in my investment portfolio by the age of 21. By following these steps, you can replicate my success and pave your way to financial prosperity. So grab a pen and a notebook, because I'm about to reveal the secrets that can make your dreams come true.

Step 1: Decide How Much to Invest

The first step towards building wealth is to decide how much of your income you are willing to put away for investing. It doesn't matter if your income is small at the moment. What's important is to develop a habit of saving and investing from an early age. Start with a percentage that feels comfortable to you, even if it's just 10% or 15%. As your income grows, your investment contribution will also increase, positioning you for greater financial prosperity in the future.

Step 2: Find a Way to Safeguard Your Money

Once you've decided on the amount to invest, it's crucial to find a way to keep that money separate and safe from spending temptations. Talk to your parents or a trusted guardian about your investment goals and ask them to help you safeguard your money. By entrusting someone to hold onto your investment funds, you can resist the urge to spend frivolously and ensure that your money is protected for long-term growth.

Step 3: Set Up the Infrastructure for Investing

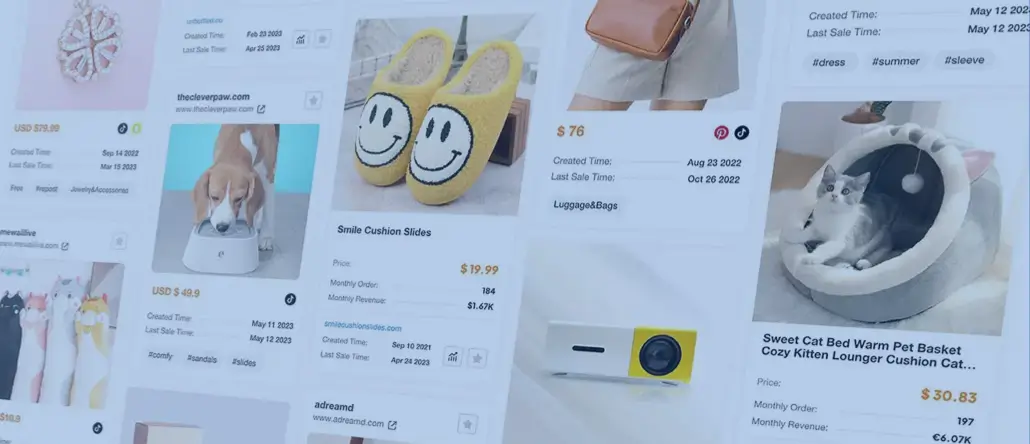

Investing may seem intimidating, especially if you're new to it. However, with the right tools and platforms available today, setting up an investment infrastructure has become easier than ever. Open an account with a reputable brokerage firm like Robinhood or WeBull for stock investing. Consider platforms like Coinbase or Binance for cryptocurrency investments. Take the time to familiarize yourself with these platforms, as they will be the foundation of your investment journey.

Step 4: Expand Your Knowledge and Stay Informed

Knowledge is power when it comes to investing. Take the initiative to learn about different investment opportunities, such as stocks, cryptocurrencies, real estate, or alternative investments like watches. Explore the market, understand trends, and gain insights into different investment avenues. Use resources like books, online courses, or informational websites to educate yourself continually. Remember, informed decisions lead to successful investments.

Step 5: Start a Business or Freelance Gig

Investments, although crucial, should not be your sole focus. Building multiple streams of income can significantly contribute to your wealth accumulation. Consider starting a business or engaging in a freelance gig to increase your income. Starting your own business, especially at a young age, can bring tremendous financial rewards. Alternatively, working for a fast-growing company can also offer lucrative opportunities for income growth.

Step 6: Live Below Your Means

Living below your means is a key principle for long-term financial success. While it doesn't mean you have to be frugal to the extreme, it's essential to keep your expenses in check. Strive to spend less than you earn, regardless of how much money you make. Avoid unnecessary luxuries and focus on saving and investing a significant portion of your income. By adopting a modest lifestyle, you can maximize your investment growth potential.

Step 7: Increase Your Investment Percentage

As your income grows, aim to increase the percentage of your income that you invest. Continuously strive to save and contribute more to your investment portfolio. By increasing your investment percentage, you accelerate your path to financial independence. Set goals for increasing your monthly or annual investment contributions and challenge yourself to stretch beyond your comfort zone. The more you invest, the greater your wealth-building potential.

Step 8: Achieve Financial Freedom

The ultimate goal of following these steps is achieving financial freedom. When your investment portfolio generates enough passive income to cover your living expenses, you have reached true freedom. Imagine a life where your investments sustain you without having to rely on a job or active income. This level of financial independence provides stability, peace of mind, and the ability to focus on pursuing your passions, personal growth, and making a positive impact on the world.

Conclusion

Becoming a millionaire or multi-millionaire by the age of 25 is an achievable goal when you follow these eight steps. Start by deciding how much to invest, find a way to safeguard your money, set up the necessary investment infrastructure, expand your knowledge, start a business or freelance gig, live below your means, increase your investment percentage, and strive for financial freedom. Remember to stay committed, be disciplined, and continuously educate yourself on investment opportunities. With dedication and perseverance, you can pave your way to financial success at an early age.

Highlights

- Learn the exact steps to become a millionaire by the age of 25.

- Start by deciding how much to invest and develop a habit of saving and investing from an early age.

- Safeguard your money by entrusting someone to hold onto your investment funds.

- Set up an investment infrastructure using user-friendly platforms like Robinhood or Coinbase.

- Expand your knowledge and stay informed about different investment opportunities.

- Start a business or freelance gig to increase your income and create multiple streams of revenue.

- Focus on living below your means and saving a significant portion of your income.

- Increase your investment percentage as your income grows to accelerate wealth accumulation.

- Aim to achieve financial freedom, where your investment portfolio generates enough passive income to cover your expenses.

- Follow these steps with dedication and perseverance to pave your way to financial success at an early age.

FAQ

Q: Can I start investing with a small amount of money?

A: Absolutely! The key is to start investing as early as possible, regardless of the amount. Even small contributions can grow over time and accumulate significant wealth.

Q: How do I decide which investment avenue is right for me?

A: Consider your interests, long-term goals, and risk tolerance. Research and educate yourself about different investment options before making informed decisions.

Q: Is starting a business the only way to increase income?

A: No, starting a business is just one option. You can also explore freelance gigs, work for high-growth companies, or invest in income-generating assets to increase your income.

Q: How can I balance living below my means and enjoying life?

A: Living below your means doesn't mean depriving yourself of enjoyment. It's about prioritizing financial security and making conscious spending decisions while still allowing yourself to enjoy the present.

Q: How long does it take to achieve financial freedom?

A: The timeline varies for each individual based on factors like income, investment performance, and lifestyle choices. However, following these steps diligently can expedite the journey towards financial freedom.